Property Tax Relief For Seniors In King County . Find out how it works. Learn more about the program to provide tax relief to property owners on a limited income. Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. They include property tax exemptions and. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for this. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities.

from dxootlnxb.blob.core.windows.net

Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. Find out how it works. Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: They include property tax exemptions and. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for this. Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Learn more about the program to provide tax relief to property owners on a limited income.

Senior Property Tax Exemption King County Washington State at Pete Wade

Property Tax Relief For Seniors In King County Find out how it works. They include property tax exemptions and. Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for this. Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities. Learn more about the program to provide tax relief to property owners on a limited income. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. Find out how it works.

From www.formsbank.com

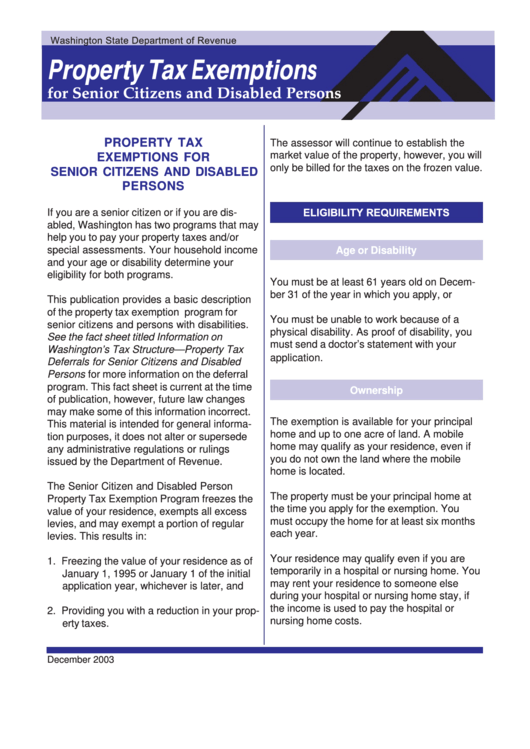

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons Property Tax Relief For Seniors In King County Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web in king county, if you are 61 years or older, own your home, and have an annual income of. Property Tax Relief For Seniors In King County.

From seniorsresourcecenter.com

Property Tax Reduction Seniors Resource Center Property Tax Relief For Seniors In King County Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income,. Property Tax Relief For Seniors In King County.

From www.bank2home.com

Veterans Property Tax Exemption Application Form Printable Pdf Download Property Tax Relief For Seniors In King County Learn more about the program to provide tax relief to property owners on a limited income. Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423. Property Tax Relief For Seniors In King County.

From fity.club

Property Taxes King County Property Tax Relief For Seniors In King County They include property tax exemptions and. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for this. Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical. Property Tax Relief For Seniors In King County.

From ceyopxll.blob.core.windows.net

Colorado Senior Property Tax Exemption Weld County at April Rowe blog Property Tax Relief For Seniors In King County Find out how it works. Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. They include property tax exemptions and. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has. Property Tax Relief For Seniors In King County.

From www.stcharlesil.gov

Property Taxes City of St Charles, IL Property Tax Relief For Seniors In King County Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Find out how it works. Web state law provides. Property Tax Relief For Seniors In King County.

From www.maca.gov.nt.ca

Seniors and Disabled Persons Property Tax Relief Municipal and Property Tax Relief For Seniors In King County Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. Find out how it works. Web the washington state. Property Tax Relief For Seniors In King County.

From agrethawgretel.pages.dev

King County Property Tax Due Dates 2024 Etty Sherye Property Tax Relief For Seniors In King County Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities. Learn more about the program to provide tax relief to property owners on a limited income. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for this. Web. Property Tax Relief For Seniors In King County.

From cekmysfg.blob.core.windows.net

Virginia Real Estate Tax Relief For Seniors at Alan Hoard blog Property Tax Relief For Seniors In King County Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: They include property tax exemptions and. Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made. Property Tax Relief For Seniors In King County.

From houstoncasemanagers.com

How The Harris County Tax Deferral Works Senior Citizen Property Taxes Property Tax Relief For Seniors In King County Learn more about the program to provide tax relief to property owners on a limited income. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for this. Find out how it works. Web state law provides a tax benefit program for senior citizens,. Property Tax Relief For Seniors In King County.

From www.covingtonreporter.com

King County audit finds backlog of property tax exemption applications Property Tax Relief For Seniors In King County Learn more about the program to provide tax relief to property owners on a limited income. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. They include property tax exemptions. Property Tax Relief For Seniors In King County.

From susannewnoami.pages.dev

King County Property Taxes 2024 Vicki Jennilee Property Tax Relief For Seniors In King County Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or long. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Learn more about the program to provide tax relief to property owners on a limited. Property Tax Relief For Seniors In King County.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Relief For Seniors In King County Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Find out how it works. They include property tax exemptions and. Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities. Web if you are a senior citizen or disabled person with your primary residence in washington state,. Property Tax Relief For Seniors In King County.

From www.kiro7.com

King County launches plan to help seniors, others with Property Tax Relief For Seniors In King County They include property tax exemptions and. Find out how it works. Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. Web the washington state legislature has made major changes in the senior citizens property tax relief program, and king county has made it easier to apply for. Property Tax Relief For Seniors In King County.

From www.uslegalforms.com

MN Application for Property Tax Exemption Carver County 20042022 Property Tax Relief For Seniors In King County Learn more about the program to provide tax relief to property owners on a limited income. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web in king county, if you are 61 years or older, own your home, and have an annual income of $58,423 or less (after certain medical or. Property Tax Relief For Seniors In King County.

From www.shorelineareanews.com

Shoreline Area News Senior and Disabled Property Tax Relief info Property Tax Relief For Seniors In King County Web if you are a senior citizen or disabled person with your primary residence in washington state, this program offers a reduction in. Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Learn more about the program to provide tax relief to property owners on a limited income. Web in king county,. Property Tax Relief For Seniors In King County.

From dxootlnxb.blob.core.windows.net

Senior Property Tax Exemption King County Washington State at Pete Wade Property Tax Relief For Seniors In King County Web state law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. Web state law provides 2 tax benefit programs for senior citizens and persons with disabilities. Web the washington state legislature has. Property Tax Relief For Seniors In King County.

From www.formsbank.com

Top 6 King County, Wa Court Forms And Templates free to download in PDF Property Tax Relief For Seniors In King County They include property tax exemptions and. Learn more about the program to provide tax relief to property owners on a limited income. Web for an exemption on your 2024, 2025 and 2026 property taxes, your household income, after deduction of qualified expenses, is $84,000. Find out how it works. Web in king county, if you are 61 years or older,. Property Tax Relief For Seniors In King County.